Selecting a Medicare Supplement, also known as Medigap, or a Medicare Advantage plan depends on your individual needs and resources. Both have a vital role to play in providing comprehensive coverage. Below are some things to consider when making your decision.

Medicare Supplement/Medigap plans are designed to help beneficiaries pay for the gaps in Original Medicare including an individual’s share of Medicare deductibles and co-insurance. Medigap policies are attractive to those who want little-to-no copays when accessing healthcare services.

Medicare Advantage was designed to provide Medicare beneficiaries with a lower-premium option. Medicare Advantage plans have very little underwriting which makes it an attractive option for those who missed their Medigap Open Enrollment period and cannot qualify for a Medicare Supplement due to health conditions.

Some of the things to take into consideration include:

- Access to doctors (specialists) and network restrictions

- Medications

- Chronic health issues

- Lifestyle (travel)

- Premiums, Deductibles, and Copay Costs

Working with an independent agent at Senior Financial Group can help you determine which coverage is best for you. Call today to schedule a one-on-one personalized needs assessment.

Medicare Advantage plans and Medicare Supplements/Medigap are optional coverage. Since Original Medicare does not have a max out of pocket, choosing between a Medicare Advantage or Medicare Supplement plan helps you to better control your out-of-pocket costs.

The premiums of a Medicare Advantage Plan are typically less than a Medicare Supplement/Medigap, in many cases a $0 monthly premium. For a Medicare Advantage plan, you pay copays and coinsurances for services as you use them. However, a Medicare Advantage plan’s maximum out-of-pocket sets a limit to the amount of copays/coinsurances you would potentially pay per year.

With a Medicare Supplement, you have more cost on the front end and very little cost on the back end. Your monthly premiums can range from under $100 to almost $300 depending on the Medicare Supplement you choose, your gender, and location of residence. Other than your monthly premium, and your Part B annual deductible, all other costs will be covered.

- For example: Plan G covers all costs once you meet your Part B annual Deductible, which is $203 for 2021. Other supplement plans could include copays for each doctor visit and Part B excess charges.

Call us today at 865-777-0153 to help you compare costs and evaluate your options. We never charge for our services!

Medicare Advantage plans may have network restrictions.

- Some plans will only cover services that are in-network; other MA plans will allow you to go in and out of network.

- While traveling, MA plans will only cover you in emergency situations unless you have out-of-network access.

- Referrals may or may not be required.

Medicare Supplements do not have any hospital/medical network restrictions.

- You can see any doctor in the country as long as they take Medicare and you are being seen for a Medicare-covered service.

- No referrals are needed

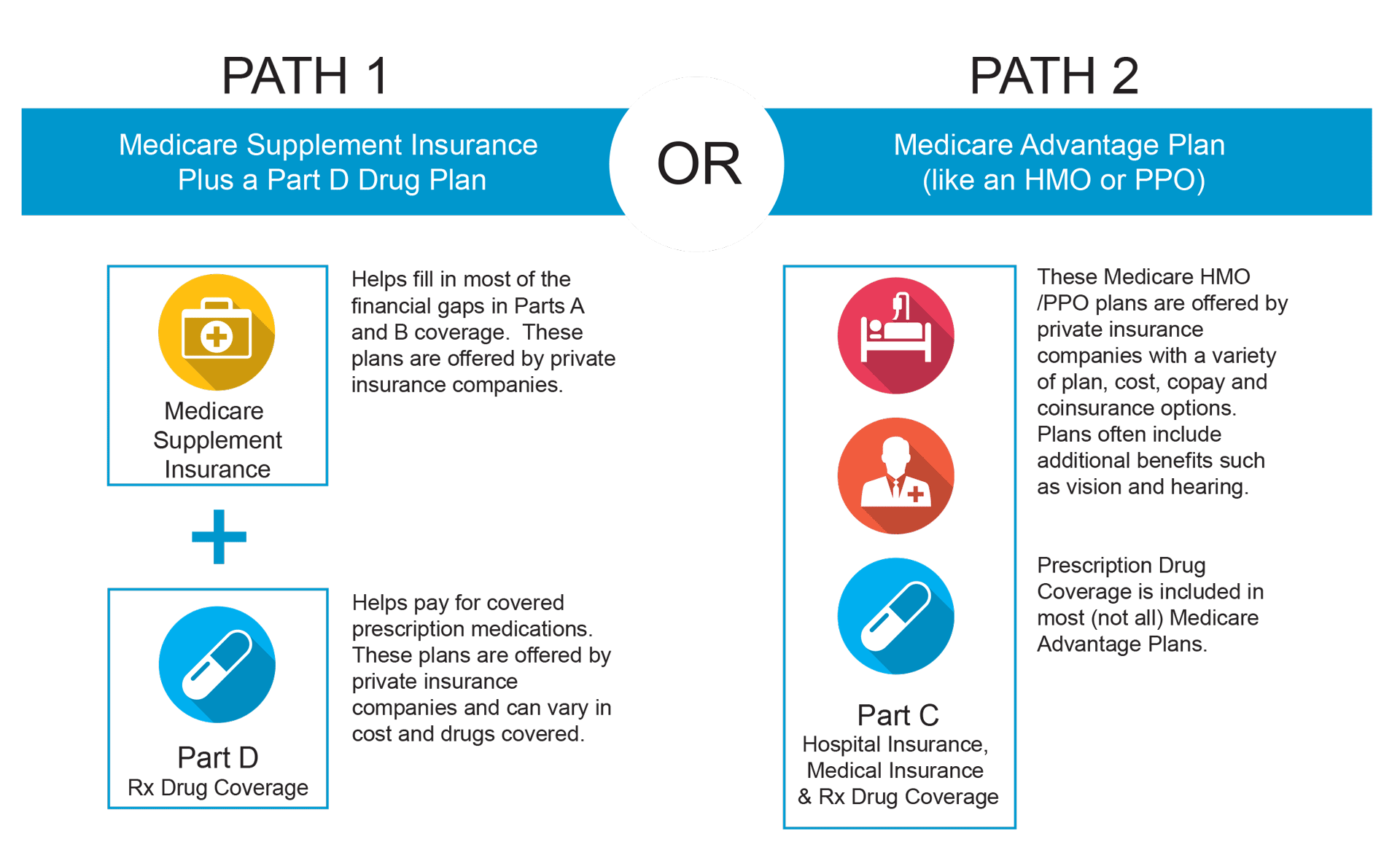

Click here to download the infographic “Choosing Your Own Path“.

No, you may only choose one path or the other. Once you enroll in Original Medicare (Parts A & B) you may choose Path 1: A Medicare Supplement and Drug Plan, or Path 2: A Medicare Advantage Plan.

Whether you are ready for initial enrollment, or want to update your plan, we can guide you through your needs assessment to help you determine your path 1 and path 2 options, comparing plans and costs, and identifying possible savings. We will help you enroll in the plan that best suits your needs.