What is a Medicare Supplement (Medigap)?

Medicare is an invaluable resource for millions of Americans, providing essential healthcare coverage as they age. However, there may be gaps in your Medicare coverage that can leave you with unexpected healthcare expenses. That’s where Medicare Supplement (Medigap) plans come in. At Senior Financial Group, we’re here to help you understand how Medigap plans can enhance your Medicare coverage and provide peace of mind.

Medicare Supplement plans, commonly known as Medigap, are private insurance policies designed to fill the gaps left by Original Medicare (Parts A and B). These plans are regulated by both federal and state governments and are offered by private insurance companies.

Key Features of Medigap Plans:

1. Comprehensive Coverage: Medigap plans help cover the out-of-pocket costs associated with Original Medicare, such as copayments, deductibles, and coinsurance.

2. Freedom to Choose Providers: With Medigap, you can choose any healthcare provider who accepts Medicare patients, giving you the flexibility to see the doctors and specialists you prefer.

3. No Network Restrictions: Medigap plans do not restrict you to a specific network of healthcare providers. You have the freedom to seek care from providers across the country.

4. No Referrals Needed: Unlike some Medicare Advantage plans, Medigap plans do not require referrals to see specialists. You have direct access to the healthcare services you need.

5. Guaranteed Renewable: As long as you pay your premiums, your Medigap plan is guaranteed to be renewable, regardless of your health status.

What Does Medigap Cover?

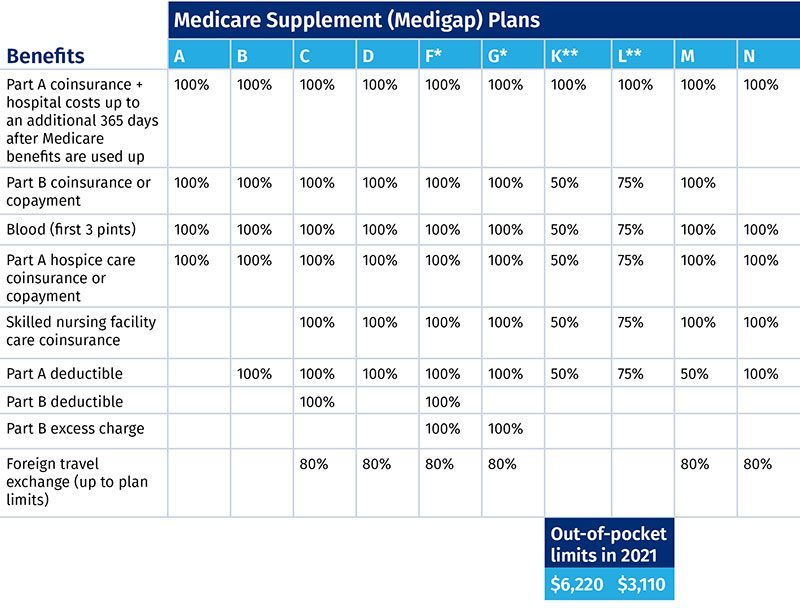

Medigap plans come in various standardized lettered plans, labeled A through N (excluding E, H, I, and J). Each plan provides a different level of coverage, so you can choose the one that best suits your needs.

Common benefits covered by Medigap plans include:

- Part A and Part B coinsurance or copayments.

- Deductibles for both Part A and Part B.

- Excess charges from providers who do not accept Medicare assignment.

- Skilled nursing facility care coinsurance.

- Foreign travel emergency coverage.

When Can You Enroll in a Medigap Plan?

Initial Enrollment Period (IEP): The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. This six-month period begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this time, insurance companies cannot use medical underwriting, so you have the opportunity to secure coverage at the best possible rates.

Special Enrollment Periods (SEPs): In certain circumstances, you may qualify for a Special Enrollment Period, allowing you to enroll in or make changes to a Medigap plan outside the standard enrollment periods.