Enrolling into Medicare can be difficult because it is dependent upon an individual’s unique situation. Are you going to keep working past 65? Are you currently contributing to an HSA? Can you defer one part and not another?

Our goal is to help you become aware of your options and deadlines surrounding your enrollment into Medicare. Through personalized analysis, we will evaluate your needs and lifestyle requirements. Together, we will find a path that’s right for you and your family. We want to reduce anxiety by minimizing your confusion and answering all your questions. Our services are always free of charge.

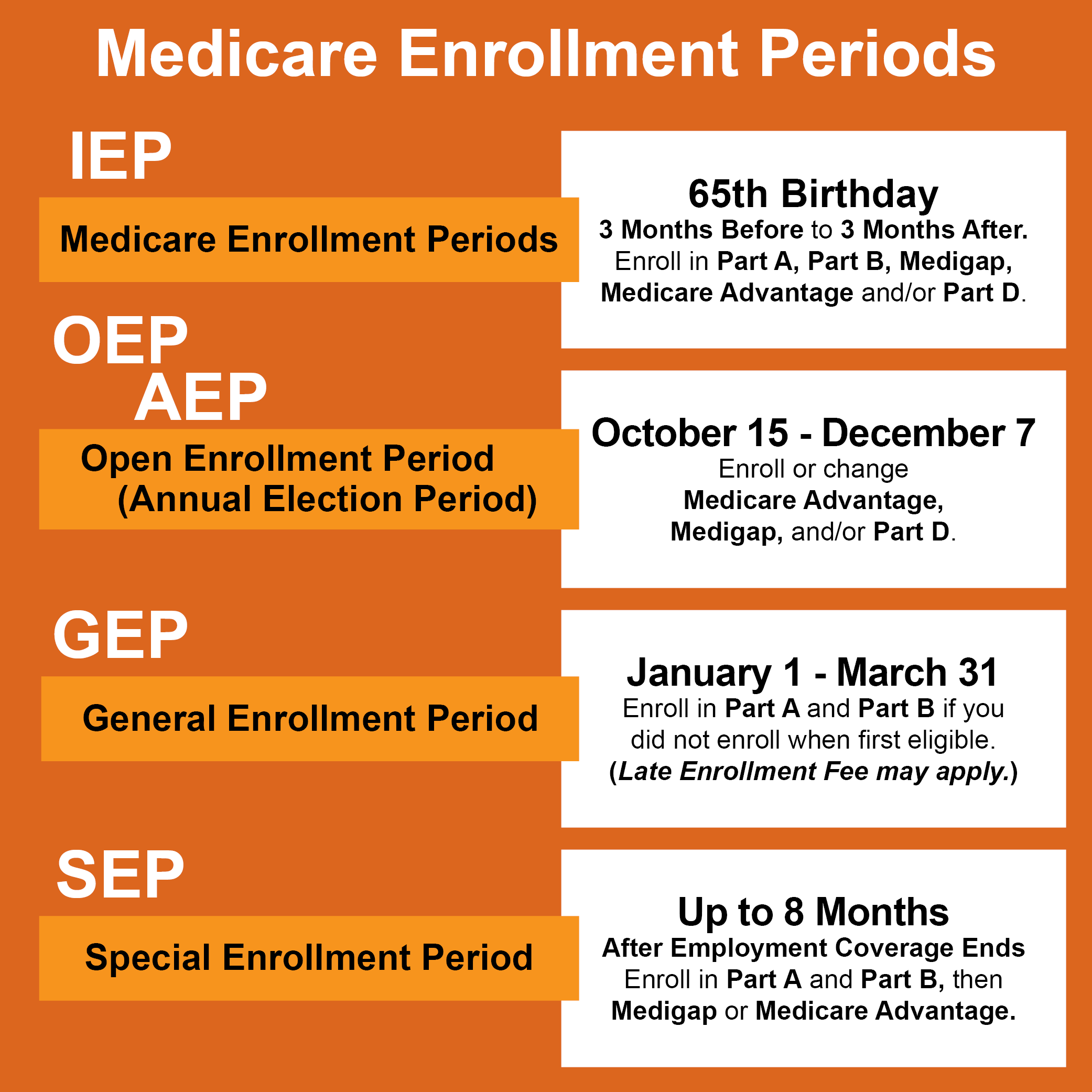

Medicare has specific periods for enrolling in and making changes to a Medicare plan. There are a few different enrollment periods based on circumstances. These include:

Medicare has specific periods for enrolling in and making changes to a Medicare plan. There are a few different enrollment periods based on circumstances. These include:

- Turning 65 (a seven-month window)

- Still working and on employer group coverage

- Retirement

- Relocation

- Financial changes

Most people are aware of the initial enrollment period when turning 65.

You are eligible for Medicare upon turning 65. The decision to enroll depends on your situation. Some questions to consider include:

- Do you plan to continue to work past your 65th birthday?

- Will you still have health insurance through your employer or spouse’s employer?

- Are you a veteran and eligible for Tricare?

- Are you entitled to coverage through a State Retirement program?

Some people receive Medicare benefits automatically, and some have to self-enroll. Here are a few scenarios of automatic Medicare enrollment.

- Currently on Social Security: If you are receiving social security retirement benefits, you will automatically be enrolled in Medicare Parts A and B. Coverage is effective the first day of the month that you turn 65 (or the previous month if your birthday is on the first day of the month). You will automatically receive your Medicare card in the mail.

- Disabled: If you are disabled, you will automatically receive a Medicare card in the mail for Parts A and B. Coverage begins the 25th month after Social Security Disability benefits begin.

- ALS: If you have ALS, you will be automatically enrolled the month Social Security Disability benefits begin.

When automatically enrolled, you will receive your Medicare card in the mail. You can return the card and defer Medicare Parts A and B if you intend to stay on group employer coverage and if your employer has more than 20 employees. Once you are ready to leave employer group coverage, you can reapply for Medicare Part A and B.

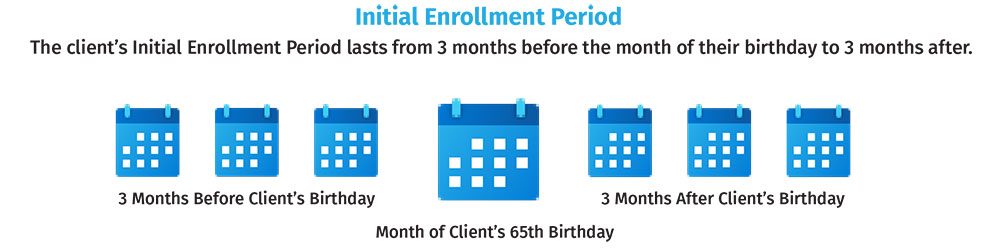

If not automatically enrolled, you can self-enroll at www.ssa.gov or by calling your local Social Security office. If you plan to enroll in Medicare at age 65, you have a 7-month window to enroll in Part A and B. The enrollment period begins three months before the month you turn 65 and ends three months after your birthday month. After the 7th month, a late enrollment penalty may apply.

If planning to work past 65, and you work for a company with 20 or more full-time employees, AND you have coverage through their group health insurance, you may not need all parts of Medicare when you turn 65.

If planning to work past 65, and you work for a company with 20 or more full-time employees, AND you have coverage through their group health insurance, you may not need all parts of Medicare when you turn 65.

You can sign up for Part A, which is free for most people, if you or your spouse have worked at least 10 years or 40 quarters. You can delay Part B and/or Part D, which are premium-based, without incurring a penalty and get them later when you retire or lose your job-related insurance. When you retire, you will have a special election period to sign up for Medicare Parts B and D penalty free.

Health Savings Account contributions cannot be continued if you sign up for Medicare, not even Part A. The IRS does not allow you to make contributions if you have two insurances and Medicare would count as a second insurance if you are on your employer’s group plan.

If you enroll in Medicare past your 65th birthday, you should plan to stop making HSA contributions 6 months prior to enrolling in Medicare, because enrollment is retroactive up to six months.

If you are staying on your employer’s group coverage, and you or your employer contribute to a Health Savings Account (HSA) on your behalf, do not sign up for Part A or B if you want to continue making contributions.

EXAMPLES:

- You are 66 and applying for Medicare in June. You should stop contributions prior to December 1 of the previous year.

- You are 65 in January but are waiting to apply in May. Part A would be retroactive to your 65 birthday in January, so you should stop HSA contributions before January 1.

If you initially delayed Part B, you will need to fill out 2 forms and send them to the Social Security office when you are ready to enroll. These can be mailed or faxed to your local office. Field Office Locator | SSA

- Form L564E is for your employer to sign.

- Form CMS40B is for you sign.

If you delay Part B without having creditable coverage – such as employer group health coverage – you may face penalties.

Note: You must indicate your preferred start date in the remarks section of form CMS-40B.

You would be required to enroll during the Part B general enrollment period (January 1 – March 31) with an effective date of July 1. The monthly penalty is permanent, 10% for every 12-month period not enrolled.

If planning to keep your employer’s coverage, you will want to compare the cost and benefits of that coverage versus Medicare to decide which is most cost effective. Everyone’s situation is different. Our Medicare advisors can help you decide if you should enroll in all parts of Medicare or only parts A and D while you are still working.

It’s our job to know everything about Medicare so you don’t have to. Senior Financial Group is here to help.

Call us at (865) 777-0153 or (800) 677-0153 to schedule an appointment or email us your questions here.